Rabbit Finance

Introduction

Rabbit Finance is a leveraged yield farming protocol based Binance Smart Chain (BSC) released by Rabbit Finance Lab. It supports users participating in liquidity farming through over-lending plus leverage to get more revenue.

When the user has insufficient funds but wants to participate in DeFi liquidity farming, Rabbit Finance can provide up to 10X the leverage to help users obtain the maximum revenue per unit time, and at the same time provide a borrowing pool for users who prefer stable returns to earn profits.

Strengths & Vision

Alpaca Finance + Badger Finance + Algorithm StableCoin

leveraged lending + Yield Farming + Algorithm mechanism

Rabbit Finance fully draws on and adopts the advantages of the projects in the market, uses the over leveraged yield farming products with the advantages of Alpaca Finance and Badger Finance, creatively combines the mechanism of algorithm stable coin to empower the RABBIT token. In the whole economic ecology of Rabbit Finance, RABBIT token, which is endowed with more application scenarios, not only represents the governance rights and interests of the leveraged yield farming protocol, but also the shareholders' rights and interests token of algorithm stable coin of RUSD. Whenever RUSD is inflationary, the members who pledge R token to the boardroom will share the additional RUSD as dividends to share the benefits of ecological growth.

Rabbit Finance believes that the levered yield farming platform will be the next killer application in the field of DeFi after the decentralized exchange and lending platform. It also believes that algorithm stable coin is the last Holy Grail in the field of DeFi. They are and will be the most important infrastructure in the DeFi world.

Rabbit Finance's vision is to become the Federal Reserve of the DeFi world, based on the principles of equal opportunity and commercial sustainability, and to provide appropriate and effective financial services at affordable cost for people of all social strata and groups who need financial services. Rabbit Finance is not a simple leveraged yield farming platform or algorithmic stable coin system. It will be a decentralized and inclusive financial services infrastructure with the ability of continuous hematopoiesis and based on blockchain technology. Compared to being the same role as the Fed, what Rabbit Finance expects goes well beyond The Fed's role in the world economy.

Strategies

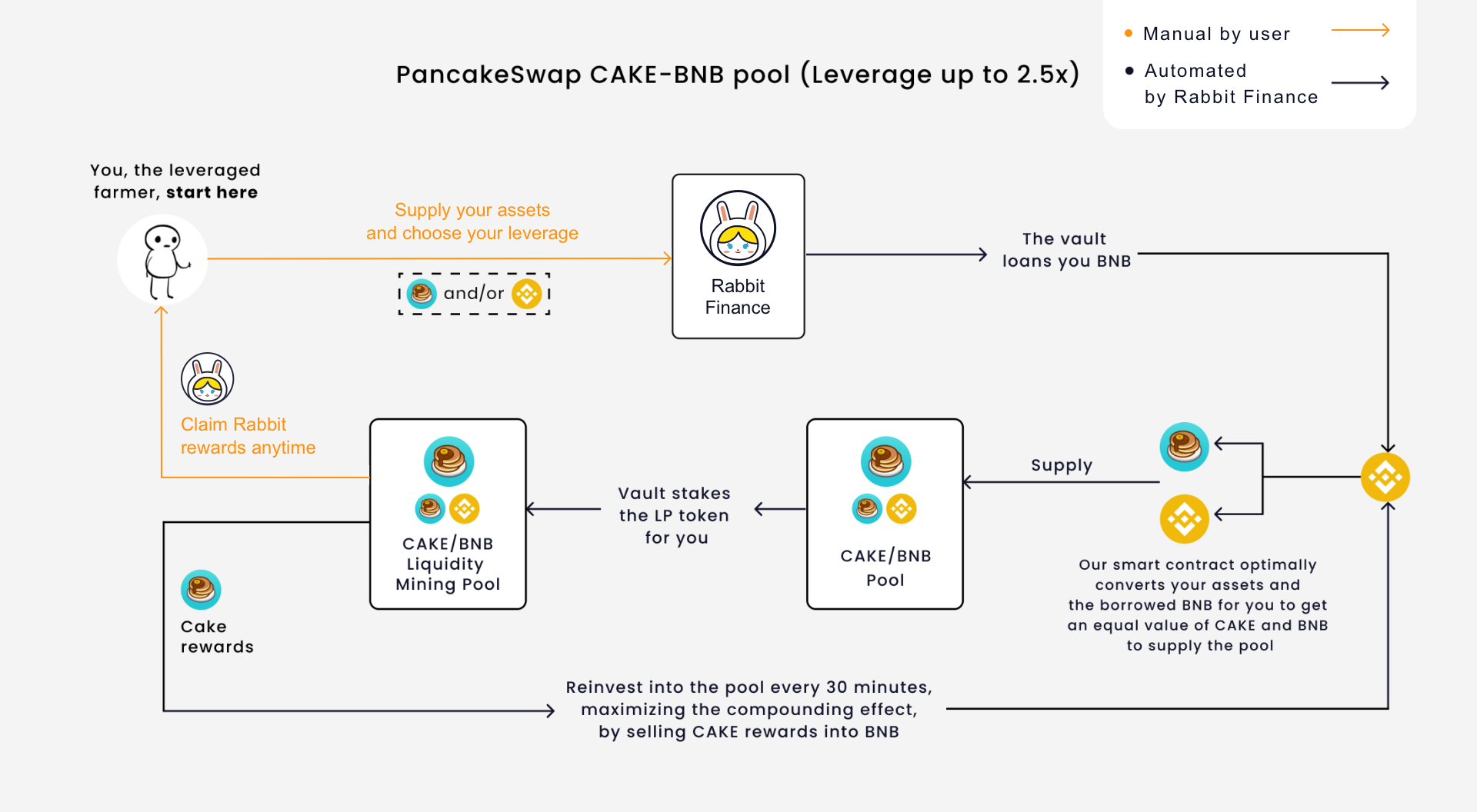

Rabbit Finance deploys strategies that work to achieve the highest possible yields for our farmers. We also want to make sure our users have the best experience when interacting with our platform. That’s why we’ve simplified the leveraged farming process by automating many things behind the scenes.

Some of our key features for enhancing usability are:

Flexible deposit options: our vault optimally converts your deposited assets and the borrowed BNB or BUSD to get an equal value-split to supply the farming liquidity pool. So for example, for the CAKE/BNB pool, you can deposit any amount of CAKE and/or BNB to start farming without having to do the conversions yourself.

Automatic staking: our code stakes the LP tokens for you on the chosen platform(PancakeSwap, etc. ) automatically, so you can start earning rewards right away.

Continuous compounding: the bounty hunter monitors the amount of rewards accrued in each pool and helps all farmers reinvest it. Our smart contract can sell your rewards(CAKE, etc.), converts them into the LP tokens for the pool you are farming, and compounds them onto your farming principal so you can maximize your APY.

Claim RABBIT rewards anytime: by opening a leveraged yield farming position, you'll earn bonus rewards that you can claim anytime on the stake page.

For specific strategies of each farming pool, please refer to the diagrams below.

Take CAKE-BNB as an example to show

Liquidation

In the event that your debt ratio has gone above the threshold (Kill Factor), your position will be liquidated.

The value you receive back after liquidation will depends on the Kill Factor. Please refers to the table below for an estimate

Kill Factor - Pools Liquidation Bounty Estimated returned value to farmer

80% CAKE-BNB 5% ~19% of debt value

83.3% BTCB-BNB 5% ~16% of debt value

ETH-BNB

BNB-BUSD

BNB-USDT

USDT-BUSD

96% DAI - BUSD 5% ~3.5% of debt value

USDC-BUSD

Example:

Dunn opened a 2x leveraged yield farming position on CAKE-BNB pool

She supplied 10 BNB

our Vault loaned her 10 BNB

We then optimally swapped BNB into CAKE and acquired LP tokens for her

At this time, 's position is ~20 BNB ( in reality, it will be slightly lower due to price impact from swapping and trading fees)

Her debt ratio is ~50%

Sometime later...

BNB price has appreciated significantly causing Dunn's position to be worth less in BNB term. This is because the LP pool will try to maintain equal value of the token pairs, causing to have more CAKE and less BNB in her position.

Unfortunately, BNB price continued to appreciate such that the debt ratio has reached 80% (Kill Factor), and the liquidation bot called the smart contract to close her position.

At this time, her position value is roughly ~12.5 BNB

10 BNB will be used to repay the loan

0.125 BNB (5% of the remaining 2.5 BNB) will be paid to the liquidator as a bounty

2.375 BNB will be returned to the user

To make this example easy to understand, please note that this example ignores the impact of yield farming rewards and trading fees which would increase Dunn's position value and make her position safer. It also ignores the borrowing interest rate which would increase the debt value, moving her debt ratio higher.

Global Parameters

Parameter - Value - Description

BNB minimum debt size - 2 BNB

The minimum amount in BNB that a user can borrow to open a leveraged position

BUSD minimum debt size - 400 BUSD

The minimum amount in BUSD that a user can borrow to open a leveraged position

USDT minimum debt size - 400 USDT

The minimum amount in USDT that a user can borrow to open a leveraged position

DAI minimum debt size - 400 DAI

The minimum amount in DAI that a user can borrow to open a leveraged position

USDC minimum debt size - 400 USDC

The minimum amount in USDC that a user can borrow to open a leveraged position

CAKE minimum debt size - 30 CAKE

The minimum amount in CAKE that a user can borrow to open a leveraged position

BTCB minimum debt size - 0.01BTCB

The minimum amount in BTCB that a user can borrow to open a leveraged position

ETH minimum debt size - 0.2ETH

The minimum amount in ETH that a user can borrow to open a leveraged position

Reserve pool take rate - 20%

Percent of the borrowing interest that is put into the reserve pool. Half is for buyback and burn of RABBIT

Liquidation bonus - 5%

Call the clearing function to clear the order person

Reinvestment bounty - 0.4%

The person who invokes the re-investment function to maximize the benefits of users

Interest = m * utilization + b

Pool Parameters

The table below describes the parameters specific to each pool:

Work factor: Maximum debt ratio when opening a position.

Kill factor: Maximum debt ratio, beyond which anyone can liquidate a position.

Platform - Pool - Work factor (leverage) - Kill factor

Pancake - CAKE-BNB: 60.00%(2.5x)- 80.00%

pancake - BTCB-wBNB: 66.67%(3.0x)- 83.33%

pancake - ETH-wBNB: 66.67%(3.0x)- 83.33%

pancake - BNB-BUSD: 66.67%(3.0x)- 83.33%

pancake - BNB-USDT: 66.67%(3.0x) - 83.33%

pancake - BUSD-USDT: 90.00%(10x)- 96.00%

pancake - BUSD-DAI: 90.00%(10x) - 96.00%

pancake - BUSD-USDC: 90.00%(10x)- 96.00%

Work factors and kill factors may be adjusted from time to time to balance risks and rewards for all users on Finance's platform. In addition, while the core developers will set the initial values, the Governance community will be able to vote to change these parameters going forward.

Pool addresses

Pancake: CAKE-wBNB

Pancake:BTCB-wBNB

Pancake:ETH- wBNB

Pancake:BNB- BUSD

Pancake:BNB -USDT

Pancake:USDT -BUSD

Pancake:DAI -BUSD

Pancake:USDC -BUSD

What is RABBIT token?

RABBIT token is a governance token of the Rabbit Finance. It will also capture the economic benefits of the protocol. There will be a maximum of 200 million R tokens.

What is the RABBIT token used for?

1. Protocol Governance

We will soon launch a governance vault that will allow community members to stake their RABBIT tokens. The RABBIT staker will receive xRABBIT where 1 xRABBIT = 1 vote, allowing them to decide on key governance decisionsIn the initial phase, governance decisions will be made on Snapshot.

2. Capture Economic Benefits of the Platform

Users of Rabbit Finance Protocol (depositors and borrowers, i.e. lenders and farmers) will be rewarded with RABBIT token for their deposit and borrow behaviors. Rabbit Finance platform will set up a buyback fund with its income, which will be used for deflation and appreciation of RABBIT token. When earnings is reinvested, 30% of that is used to RABBIT repurchase fund. The 20% of the depositor’s interest income is used as market development fund. All of these will contribute to RABBIT's demand increase and value growth.

3. Capture Economic Benefits of the RUSD, RBTC, RBNB etc.

RABBIT token is the shareholders' rights token of algorithm stable coin of RUSD, RBTC, RBNB etc. Whenever RUSD etc. is inflationary, the members who pledge RABBIT token to the boardroom will share the additional RUSD as dividends to share the benefits of ecological growth. For more details, please pay attention to our follow-up announcement.

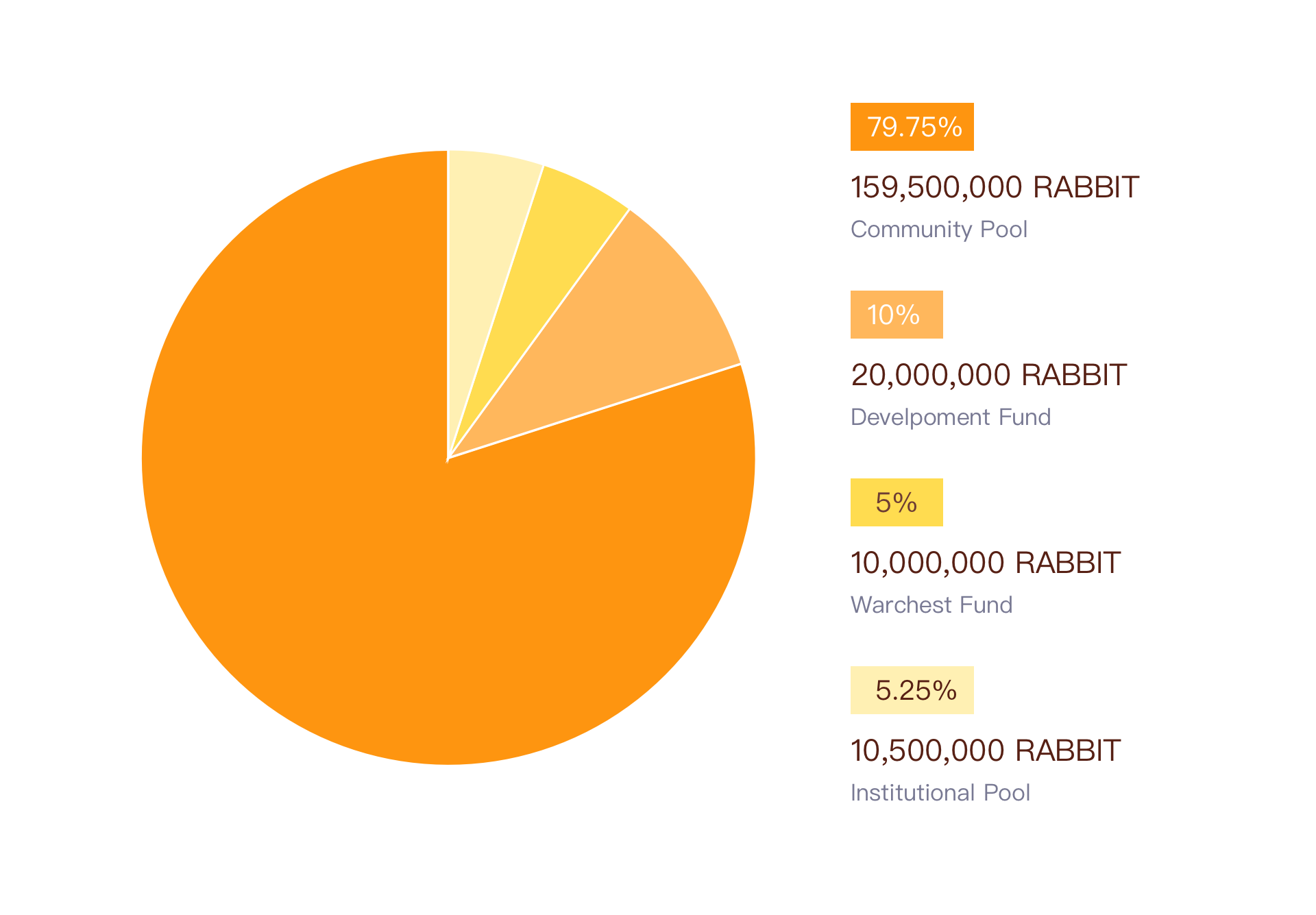

RABBIT distribution

1. Community Pool

79.75% of total supply,about 159,500,000 RABBIT.

RABBIT will be released over two years with a decaying emissions schedule, and will be evenly distributed to the entire ecosystem as a community reward.

2. Institutional Pool

5.25% of total supply,10,500,000 RABBIT

Provide 5.25% investment quota for well-known institutions and investors. After the completion of the investment, 245,000 RABBIT will be released every 7 days, and 10,500,000 RABBIT will be released within 300 days (about 10 months). Specific time to be determined, please pay attention to the follow-up announcement.

Hard cap:10,500,000 RABBIT = 525,000 USDT

Exchange ratio: 1 RABBIT= 0.05 USDT

3. Development Fund

10% of total supply,about 20,000,000 RABBIT

10% of the distributed tokens will go towards funding development and expanding the team, and will be subject to the same two-year vesting as the tokens from the Fair Launch Distribution.

4. Warchest Fund

5% of total supply,about 10,000,000 RABBIT.

5% of the distributed tokens is reserved for future strategic expenses. In the first month, 250,000 tokens were released for listing fees, auditing, third-party services, and liquidity of partners.

Officially Launched

Levered yield farming launched, farmers can open leveraged yield-farming positions and get RABBIT reward.

When we complete our smart contracts audits, we will open the leverage yield farming function, thus completing our service loop. Our current estimate for this is at the end of the April, 2021

We will make a separate announcement in advance to the community before launching Phase 2

The bonus period lasts about one week, after which the project officially starts, Rabbit's allocation plan will be updated as follows:

40% distributed to liquidity providers for the RABBIT- pool on PancakeSwap

25% distributed to lenders who deposit BNB or BUSD and other token into our vaults — rewards will be divided equally between the pools

35% distributed to users who have leveraged yield-farming positions opened — rewards will be calculated based on the loan amount; only leverage positions ( > 1x) will receive rewards

Pools Allocation

Below are points allocation to each pool which determine the rewards distributed.

Bonus Period

Open deposit vaults & pancakeswap liquidity pool, emission rate: 42 RABBIT /block. It lasts about one week.

Pools - RABBIT / block

Deposit Pool: ibBNB - 2.52

Deposit Pool: ibBUSD - 2.52

Deposit Pool: ibUSDT - 2.52

Deposit Pool: ibUSDC - 2.52

Deposit Pool: ibDAI - 2.52

Deposit Pool: ibBTCB - 2.52

Deposit Pool: ibETH - 2.52

Deposit Pool: ibCAKE - 2.52

Pancakeswap RABBIT-BNB LP - 21.84

To conclude

Rabbit Finance fully draws on and adopts the advantages of the projects in the market, uses the over leveraged yield farming products with the advantages of Alpaca Finance and Badger Finance, creatively combines the mechanism of algorithm stable coin to empower the RABBIT token. In the whole economic ecology of Rabbit Finance, RABBIT token, which is endowed with more application scenarios, not only represents the governance rights and interests of the leveraged yield farming protocol, but also the shareholders' rights and interests token of algorithm stable coin of RUSD.

Rabbit Finance can provide up to 10X leverage to help users obtain the maximum revenue per unit time, and at the same time provide a borrowing pool for users who prefer stable returns to earn profits.

Join our community

Rabbit Finance website: http://rabbitfinance.io/

Github: https://github.com/RabbitFinanceProtocol

Twitter: https://twitter.com/FinanceRabbit

Telegram: https://t.me/RabbitFinanceEN

Discord: https://discord.gg/tWdtmzXS

Contracts info: https://app.gitbook.com/@rabbitfinance/s/homepage/resources/contract-information

Audit report: https://app.gitbook.com/@rabbitfinance/s/homepage/resources/audit-report

Author : ngkas.street

BSC(BEP-20) Wallet 0xFb933dB039AD64023881bD0eEB4e1fcC22DD9123

Komentar

Posting Komentar